Austin Home Prices Are Weird

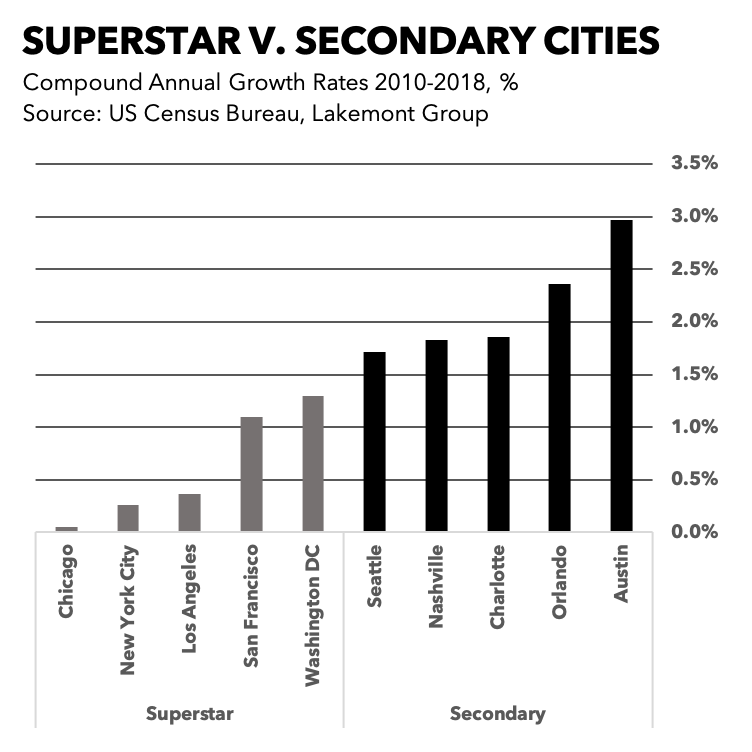

“Everything is bigger in Texas.” In addition to high school football, cattle horns, and Whataburger, this sentiment certainly rings true for the housing market of Austin, Texas. Included in our definition of secondary cities (despite not having a professional sports team…please don’t complain Longhorn fans…), Austin is the home of the University of Texas, Bevo, South by Southwest, and the oft repeated slogan “Keep Austin Weird”.

What some may consider weird, is that the home prices in this secondary city are outpacing more major Texan metros such as Dallas and Houston (you know, the ones with the professional sports teams). In fact, as recorded by Zillow! as of 2019 Q2, these three Texan cities have median home values as follows:

Austin: $321,600

Houston: $186,700

Dallas: $164,700

You read that correctly, as of 2019 Q2, you could purchase a median priced home in both Houston and Dallas for only $30,000 more than one median priced home in Austin. But why?

While the growth is popularly attributed to the growth of tech industry in Austin (see: South by Southwest), Dallas and Houston continue to see growth in corporate headquarter relocations and even boast higher household median incomes (fact check for recency). Austin is experiencing extremely high growth, but growth and resultant increase demand is only one part of the equation.

Dallas and Houston are both recognized as pro-business, pro-growth metros. The non-existence of a zoning code in Houston is a popular reference and reminder of the tenor of these cities. As a result, through the 2010s Houston and Dallas have approved their fair share of building permits to help keep pace with growth. On the other hand, Austin has many municipal laws limiting lot sizes and building heights, preventing construction of high-rise apartments. Additionally, single family residential zoning makes up the majority of the rest of the city. The city also contains an abundance of preservation reserves (unbuildable).

In combination with the regulatory constraints, Austin sees many neighborhood groups that advocate together through the Austin Neighborhood Council to stall development of anything on the edge of code.

These factors create a classic economic example of an increase in demand (due to Austin’s high growth rate), and a constraint in supply, leading to an increase in price. The rise in home prices, and decrease in affordability, can lead to a homogeneity in neighborhoods of affluent residents. And at that point (despite the presumably good intention of regulation and Neighborhood Council), it may be time for Austin to pick a new slogan.