Not Just For Start-Ups Anymore, Coworking with the Fortune 100

The terms “Coworking” and “Space as a Service” often prompt visions of start-up technology companies, huddled around brand new MacBooks while sipping espresso on overly long tables. The companies are small teams, maybe a founder and the first few hires, and the space as a service concept adheres with their preference to limit additional overhead as they build minimum viable products and source capital. Admit it, that is the picture in your head, right?

Well, you’re partly correct. But there is another segment in the trend of space as a service that deserves just as much attention in the next decade. For just a minute, forget about the picture of small, start-up companies in coworking. Instead, think of larger companies. Now even larger companies. In fact, how about the largest companies? Think of the Fortune 100.

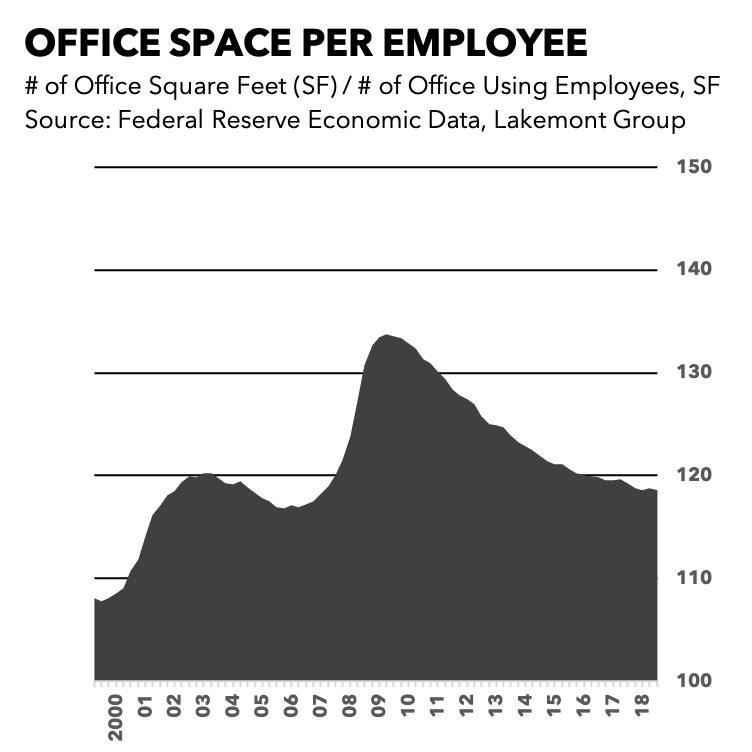

Note: We’ve seen a drop in the number of square footage of office space per employee (even considering the glut of inventory during the recession). Part of this can likely be attributed to office redesigns and the influence of coworking.

Microsoft was one of the first dominos in the Fortune 100 to fall into coworking, when in 2016 it announced that allowed staff to work from WeWork in select cities. And as of 2018, WeWork counted Bank of America, Starbucks, HSBC, Facebook, and Salesforce.com as a few of its enterprise customers. While start-ups and individuals typically engage in monthly arrangements at WeWork, these types of enterprise customers have annual terms (and longer).

In 2017, the following data was released by WeWork related to enterprise growth:

The number of WeWork’s customers with 1,000+ employees doubled.

These types of enterprise customers accounted for 25% of WeWork’s annual revenue.

These types of enterprise customers accounted for 30% of WeWork’s new monthly revenue.

This type of enterprise activity is not limited to WeWork. Other coworking companies have entered into contracts with large companies as well. Additionally, enterprise companies are creating their own coworking spaces and partnerships. Bosch started a coworking space in Chicago for innovation in Internet of Things (IoT) in May 2017. Verizon opened an “Open Innovation” lab in New York’s Silicon Alley in December 2017 with access to 5G. Though not purely coworking spaces, similar agglomeration effects are realized.

In addition to agglomeration effects, enterprise customers are lured to coworking arrangements for many of the same reasons as smaller companies. Premium infrastructure without large capital investment, flexibility in comparison to traditional lease structures with regard to growth, and cost cutting are seen as benefits of coworking spaces.

Let’s circle back to Microsoft’s initial agreement with WeWork in 2016. Their one-year commitment for 300 employees from their sales team in New York City included access to over 30 different office buildings throughout the city, with bookable space and conference rooms. What type of traditional lease structure could afford this type of flexibility for a sales team on the move?

These longer-term (for coworking…) enterprise arrangements can prove crucial to coworking spaces viability in the next decade as it lessens the volatility in revenue from the shorter-term tenants. And as coworking companies such as WeWork move towards IPO, this added stability will drive value.

The marked increase in coworking engagements from enterprise companies from 2016 to today indicate that we are already in a world where coworking has clearly reached enterprise. First movers have moved, and more reactionary companies will likely follow suit assuming the benefits of coworking engagement maintain. As we move into the 2020s, don’t limit your perception of coworking spaces to small, lean, start-ups. Don’t forget the large companies.